Maintaining Profitability During Crisis

Businesses large and small are currently faced with the overarching challenge of how to stabilize their operations and maintain profitability while communities take measures to stem the spread of COVID-19. While the crisis has generated growth for certain business segments, such as those who deliver products directly to consumers’ homes, for most firms this is a time of uncertainty during which a few key actions can help the organization survive.

At Bâton Global (B|G), we recommend leaders consider four focal areas to address the short-term liquidity and profitability challenges during the crisis as follows:

1. Get the House in Order

In times of crisis, balancing execution speed with impact to the firm is the first priority. However, chaos, corporate culture and information overload may hinder organizations from achieving these objectives. Hence, leaders should enable quick decision-making by managing information towards actionable insights, formulating data-driven solutions, communicating plans clearly to their workforce and tracking impact.

These tasks can be streamlined into the following action steps:

Activate the Crisis Team

No organization can afford inaction during a crisis. Corporate leaders should establish a crisis team of specialists that enables cross-functional decision-making.

Assess the Situation Frequently

Use crisis teams to assess emerging scenarios and business implications as often as necessary to drive quick situation assessments and responses.

Establish Organizational Alignment

Buy-in from senior leadership is essential for defining what to do and what not to do, ensuring that your organization saves resources for mission-critical tasks. What are you not willing to negotiate — mission, vision, values, etc.? Put the rest up for consideration and revision over time.

Communicate + Track Decision Impacts

Once decisions are made and alignment secured, use the crisis team to communicate decisions, ensure smooth execution and monitor effectiveness. Cross-functional crisis teams can ensure messaging is easy to interpret — as well as hard to misinterpret.

2. Conduct Dynamic Data-Driven Scenario Planning

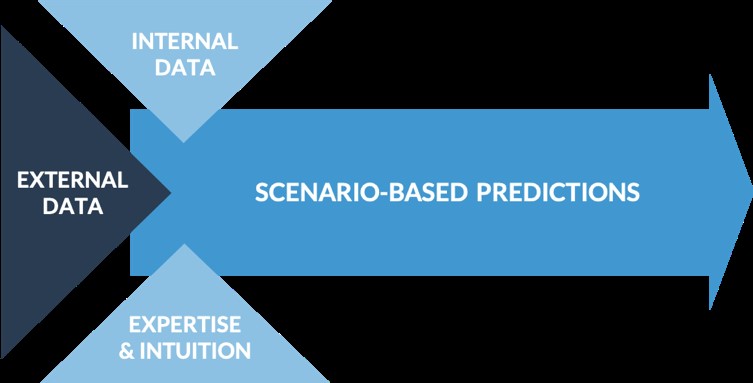

Due to the shifting market forces and uncertainties created by COVID-19, organizations are required to make profound changes to their organizations’ budgets and plans. B|G has found that organizations tend to rely heavily on the expertise and intuition of leaders, but they also have access to abundant sources of internal data including sales and expense data and data from outside forces such as economic, sociopolitical and industry data. To leverage this data and perform dynamic scenario planning, B|G recommends the following approach:

- Identify relevant internal and external data sources

- Utilize data analytics to create financial predictions

- Leverage leadership expertise to refine the scenario planning model

- Review scenarios and their implications during budgeting and planning

3. Balance Sheet Management Fundamentals

COVID-19 has severely affected firms’ ability to sustain healthy revenue and cash flow figures. Thus, it is crucial for your organization to ensure balance sheet management excellence to optimize its cash cycle conversion by improving account receivables and payables.

4. Minimize the Risk of Eroding Margins

On the revenue side, leaders need short, medium and long-term plans to recover revenue. Three factors guide how firms can guard their revenue:

Change in Customer Demand

Leverage Agile methodology to unlock innovative solutions to changes in consumer behavior as traditional segments stay home and practice social distancing.

Supply Chain Disruptions

Develop strategies to mitigate against supply chain disruptions — including diversifying your worldwide supplier networks. Even brilliant new offerings will be ineffective if the products or services cannot be delivered.

Price Changes

Avoid incrementally increasing product prices during this period. Focus instead on maintaining a great customer experience and keeping brand loyalty intact.

On the cost side, prudent capital spending in the following key cost centers should be in place:

Human Resources

Potentially institutionalize hiring freezes, offer unpaid leave and institute temporary salary cuts for top management. Align incentives by rewarding staff efforts to save so that cost reduction initiatives do not compromise revenue-generating capabilities.

Marketing Channels

Prioritize high ROI channels which may include new digital channels and online marketplaces.

OPEX

Reduce non-core operating expenditures and delay lease renewal payments where possible.

Technology

Focus on investing in technology and automation and reexamine your current physical footprint.

We like to say that the future is already here, just unevenly distributed. The severity of long-term changes to commercial activity from COVID-19 will depend upon our collective ability to get the virus under control and protect vulnerable populations reliably. It is likely that we will see changes to global supply chains, a greater acceptance of flexible work arrangements and a new awareness of the importance of quality governance of public goods. In the meantime, each organization successful in stabilizing operations can attempt to leverage the crisis to engage in strategic renewal, drive innovation and recommit to focus on fulfilling its core mission.

View the entire webinar below:

You can count on The Partnership to continue to share accurate and fact-based updates as well. See more on COVID-19 here.

Jeff Kappen

Jeff Kappen is a managing partner at Bâton Global in Greater Des Moines (DSM), as well as an associate professor of management and international business at Drake University.